What You Need to Know to Save on Fuel Contracting

November 5, 2019

Written By Tim Danze

The leaves are changing colors, temperatures are dropping, and harvest has begun. Autumn has arrived and so too has the time of year when it pays to be thinking of your fuel needs.

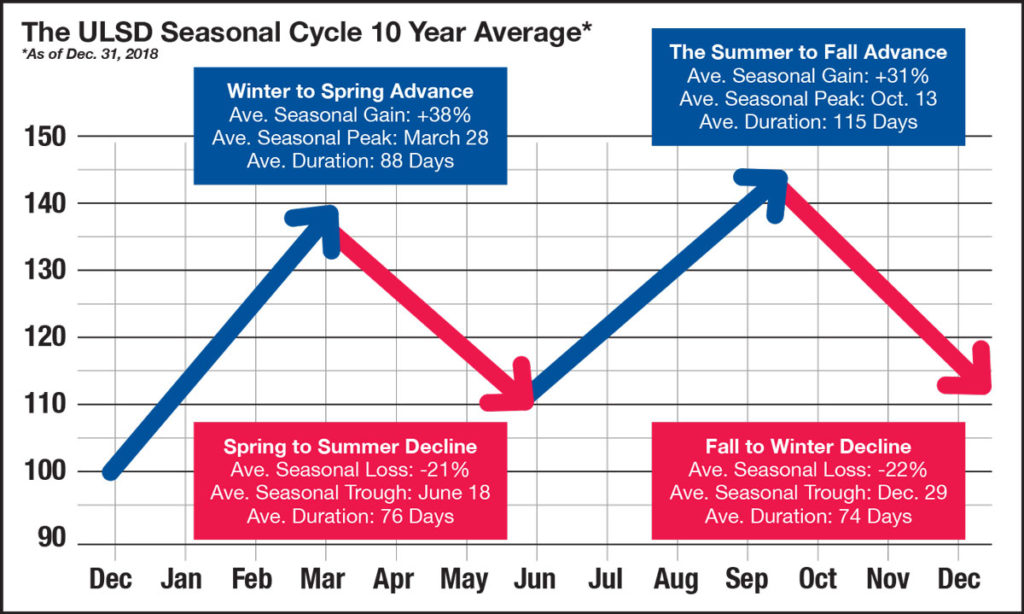

If you look back at the seasonal cycle of ultra-low sulfur diesel (ULSD) futures on the New York Mercantile Exchange (NYMEX) over the last 10 years, you can see trends that have historically led to great buying opportunities. Now, keep in mind that each year’s performance will always be unique to the circumstances at the time, and I’ll be referring to averages, but the data gives us a decent idea of what to expect.

When looking back from 2009 to the present, we typically see prices begin to climb in mid-June and peak in mid-October. The average gain in value of this seasonal run-up over the last 10 years has been 31 percent. Prices then historically move lower until the end of December for an average decline of 22 percent.

The most significant factor impacting demand at the moment is the trade war between China and the United States. The two countries have taken turns slapping each other’s imports with tariffs since January 2018. The dispute has put a damper on the global economy, which in turn, has put pressure on energy prices.

Everyone wants to know if and when the trade war might end, and there’s been talk of incremental progress through phased deal-making, but no specifics have been shared to date. Until a deal is reached, we can only speculate whether it will be enough to boost economic activity and increase fuel demand.

Since June 2019, the NYMEX ULSD price has twice rallied to new highs and sold off to near the same lows. As I write this column in mid-October, the price is back in the middle of that trading range. Taking recent seasonal trends into consideration, I would think any move higher would be temporary as the cyclical influence we typically see at the end of the year grows.

As I have stated in prior columns and meetings, the best time to consider locking in the price of some of your expected fuel volume for the upcoming year is now. The stretch of time from November to March consistently offers you the most advantageous chance to book fuel for the upcoming season. This is when you need to be paying attention to the energy market and preparing to make a move.

If you want to be as informed as possible when you contract your fuel needs for the upcoming season, you need to do three things: estimate your total fuel volume needs, the timeframe when you will use your fuel and the average price per gallon you can afford to pay.

Once you determine that information, you will be ready to ask your local plant manager for a quote on contract pricing. The length of contract can be set up for the timeframe that best meets your needs. After you get a quote, evaluate it in comparison to your per-gallon budget. Knowing what the potential contract values are today gives you a point of reference that you can compare against as the year progresses.

You also need to decide what percentage of your normal fuel needs you want to protect through contracting. We generally do not advise contracting for 100 percent of your expected fuel needs except in rare circumstances. We recommend you pick a percentage that makes sense for your plan for the next five months. The goal is not to try to buy the absolute low, but rather to lock in a price that best fits your budget.