Author: Tim Danze

What Will Move the Market?

Have you ever had your vehicle stuck in the mud? It’s a frustrating experience. You’re in a deep rut, spinning your tires but going nowhere. Or maybe you start inching forward, but the moment you ease off the gas, you slide back and are stuck again. This is how the […]

Volatility Can and Will Surprise Us

Crude oil is the essential starting point for all energy products. It also accounts for the most significant percentage of energy product prices. Over the last 10 years, crude oil has made up roughly 53.93% of retail gasoline prices and 47.3% of retail diesel prices, according to the U.S. Energy […]

Recessionary Questions Remain

Recession, recession, recession. I have been thinking and writing about this for years now. Have we already had one? Are we in one now? Are we going to have one? These are important questions, and if you ask around, you could find someone who thinks the answer is yes to […]

Inventory and Recessionary Concerns Drive Prices

Two forces opposing market forces—low inventories and recessionary concerns—are battling to determine the direction of diesel fuel prices in the near term. From a supply standpoint, total distillate inventories stood at 116.020 million gallons as of the week of Sept. 9., 2022. At the same time last year, there were […]

War, What Is It Good For? Absolutely Nothing

On Feb. 18, 2022, six days before the Russian invasion of Ukraine began, West Texas Intermediate (WTI) crude oil was trading at $91.07 per barrel. Since then, many countries have condemned the Russian aggression and responded to it with sanctions and banning imports of Russian energy products. As of May […]

What’s Behind Rising Fuel Prices?

The energy markets have been on a tear to the upside recently. Prices have recovered over 50 percent from the pandemic lows, and it seems nothing, not even the latest COVID-19 variant, can derail the momentum. Energy analysts and companies are trying to figure out the current supply situation as […]

Propane Supplies Lower Than Normal Heading Into Winter

You likely have seen many signs from employers seeking workers lately. Bloomberg reports thousands of cities and states across the United States are facing the most acute labor shortage in recent memory. The high demand for workers is across the board in a wide range of industries. The U.S. labor […]

Lessons Learned from 2020

The coronavirus pandemic turned our lives upside down. Everyone was affected in some fashion. Now that we hopefully see some light at the end of the tunnel, it’s worth looking back to see what we can learn from the experience. My biggest takeaway is to take nothing for granted, especially […]

How Will the Biden Administration Affect the Energy Market?

On Jan. 20, Joe Biden was inaugurated as the 46th president of the United States of America. While the coronavirus pandemic and the country’s economic situation will dominate much of his early days in office, there are many climate and energy issues Biden addressed through executive actions on day one […]

Turmoil in the Middle East and Its Influence on the Energy Market

As I write this latest market commentary article in mid-January, we have just gone through some serious geopolitical events in the Middle East. On Jan. 3, the United States launched an attack near the Baghdad International Airport that killed Major General Qassem Soleimani, who was the commander of Iran’s secretive […]

Now What?

After the coronavirus caused a precipitous decline in WTI crude prices that saw oil futures take an unprecedented dip into negative territory, it’s fair to wonder what we can expect moving forward. Will there be a so-called new normal for energy prices, or can we expect more of the same? […]

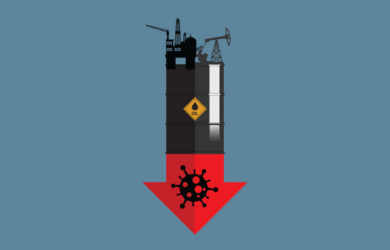

Why WTI Oil Prices Crashed

The U.S. crude oil market ventured into unprecedented territory on Monday, April 20, when prices turned negative. Futures on the New York Mercantile Exchange for soon-to-expire May contracts of West Texas intermediate crude oil, or WTI, fell to -$37.63 a barrel by the time the market closed. WTI serves as […]