Volatility Can and Will Surprise Us

October 6, 2023

Written By Tim Danze

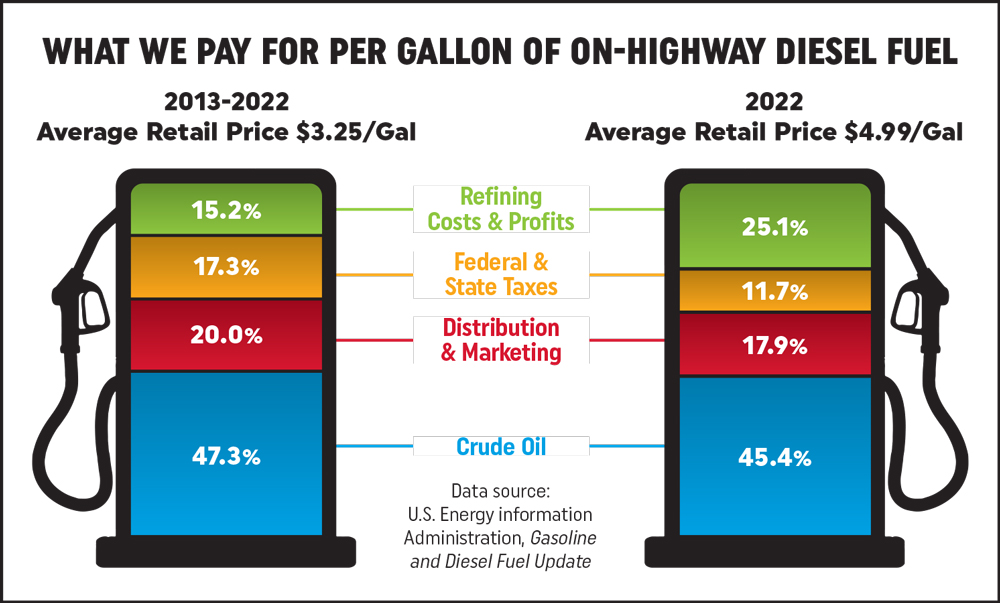

Crude oil is the essential starting point for all energy products. It also accounts for the most significant percentage of energy product prices. Over the last 10 years, crude oil has made up roughly 53.93% of retail gasoline prices and 47.3% of retail diesel prices, according to the U.S. Energy Information Administration.

Most markets nowadays are global, including energy, which fluctuates based on international events. It might be easier to make a list of the things that don’t impact energy prices than to make an exhaustive list of the things that do. The most significant factors are things we know and hear about in the news. Wars, global civil unrest, pandemics, terrorist attacks, supply, production, economic outlooks and financial markets all play a role in creating volatility and sudden swings in pricing.

In today’s world of instant information, energy markets change fast and furiously. There are many times when prices overreact to initial news only to calm down as more details or the real picture becomes more apparent. I mention this because it’s an excellent reminder to all of us that, often, having patience and remaining calm are the best things we can do.

The petroleum industry is competitive and posts its prices on big signs at locations for all to see, making it very transparent. Pricing is also posted on internet sites and apps where you can find the local fuel cost across the country with just a few clicks.

Every business has unique cost structures, but most fuel supply companies must deal with expenses relating to distribution and transportation, marketing, insurance, salaries and benefits, taxes, and more. These can all vary, but most companies work hard to control these costs in this industry because of the competitive nature of retail pricing.

Local issues can also impact prices, which we recently saw in the gasoline market. Wholesale prices jumped 50 cents per gallon in one day and then another 25 cents a day later. Retail prices cannot react this quickly to keep up with price jumps like these, but retail prices did go higher. Many were shocked by this development as there was no indication of any potential concerns about pricing changes of this magnitude.

One of the major reasons prices jumped the way they did was because of the anticipated changeover from summer to winter gasoline blends. Summer gasoline has a lower Reid Vapor Pressure (RVP) rating, meaning they are less volatile and less likely to evaporate. Conversely, winter-blended gasoline has a higher RVP level. The lower the RVP, the more expensive the fuel is to produce.

Many companies were trying to keep their summer gas inventories low so they could buy cheaper winter gas as the Sept. 15 switch approached. A few companies misjudged the market and, with heavy Labor Day traffic and good demand, got caught short with their supply. These companies needed to buy gas and needed it immediately. The gas available was summer-blended (more expensive) and was in limited hands as most companies were prepared for the seasonal fuel switch.

The limited supply created higher prices, forcing companies to buy at elevated prices. It was a classic short squeeze. Wholesale costs increased by more than 70 cents in two days, which is a huge move. A day later, prices came down roughly 30 cents, and they have continued to ease downward. These are classic examples of volatility at play in the market.

Energy prices are volatile, which is the one thing we can always count on with commodities—volatility. This is yet another reminder that volatility is a significant factor for all the commodities we deal with, and, at times, we will see periods of extreme movements. Times of relative calm or normalcy can lull us into a false sense of security. As mentioned, the best course of action is to stay calm and give the market time to digest all the factors before making any rash decisions.