Post Tag:

Market Commentary

Lessons Learned from 2020

The coronavirus pandemic turned our lives upside down. Everyone was affected in some fashion. Now that we hopefully see some light at the end of the tunnel, it’s worth looking back to see what we can learn from the experience. My biggest takeaway is to take nothing for granted, especially […]

How Will the Biden Administration Affect the Energy Market?

On Jan. 20, Joe Biden was inaugurated as the 46th president of the United States of America. While the coronavirus pandemic and the country’s economic situation will dominate much of his early days in office, there are many climate and energy issues Biden addressed through executive actions on day one […]

Turmoil in the Middle East and Its Influence on the Energy Market

As I write this latest market commentary article in mid-January, we have just gone through some serious geopolitical events in the Middle East. On Jan. 3, the United States launched an attack near the Baghdad International Airport that killed Major General Qassem Soleimani, who was the commander of Iran’s secretive […]

Now What?

After the coronavirus caused a precipitous decline in WTI crude prices that saw oil futures take an unprecedented dip into negative territory, it’s fair to wonder what we can expect moving forward. Will there be a so-called new normal for energy prices, or can we expect more of the same? […]

The Day the Crude Futures Market Broke

On April 20, the energy market did something we’ve never seen before. Futures on the New York Mercantile Exchange for May contracts of West Texas intermediate crude oil, or WTI, traded to a low of -$40.32 per barrel and settled at -$37.63 per barrel on the same day they were […]

Why WTI Oil Prices Crashed

The U.S. crude oil market ventured into unprecedented territory on Monday, April 20, when prices turned negative. Futures on the New York Mercantile Exchange for soon-to-expire May contracts of West Texas intermediate crude oil, or WTI, fell to -$37.63 a barrel by the time the market closed. WTI serves as […]

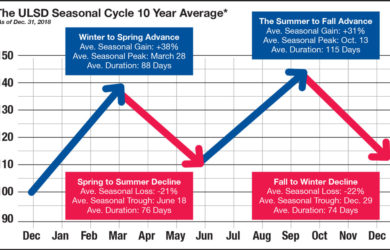

What You Need to Know to Save on Fuel Contracting

If you look back at the seasonal cycle of ultra-low sulfur diesel (ULSD) futures on the New York Mercantile Exchange (NYMEX) over the last 10 years, you can see trends that have historically led to great buying opportunities. Now, keep in mind that each year’s performance will always be unique […]

What You Need to Know to Save on Fuel Contracting

The leaves are changing colors, temperatures are dropping, and harvest has begun. Autumn has arrived and so too has the time of year when it pays to be thinking of your fuel needs. If you look back at the seasonal cycle of ultra-low sulfur diesel (ULSD) futures on the New […]

Planning for Upcoming Energy Needs

As summer begins to wind down, there are a number of things I am closely watching that could sway the direction of the fuel and propane market. I would advise you to consider these factors in preparation for your energy needs for the fall and winter. Deal or No Deal? […]

IMO 2020 Could Disrupt Distillate Markets

The International Maritime Organization (IMO), which regulates global shipping, is set to roll out new regulations at the start of next year to reduce sulfur content in fuels used by shipping vessels. You may be wondering what bearing oceanic cargo ships have on a farm cooperative here in the Midwest […]

Fuel Contracting Enhancements Now Available

Enhancements are coming to MFA Oil’s fuel contracting program. Contracting is a valuable tool you can use to lock in fixed or maximum pricing on a set number of gallons. This provides clarity for budgeting your fuel expenses. These benefits are hallmarks of our contracting program, and they will remain […]

Taking a Wider View

The energy market is full of questions these days. What is the Organization of the Petroleum Exporting Countries (OPEC) up to and has the cartel reestablished its relevance? How much of a factor is Russia playing? Where does the United States stand with its abundant shale oil production and new […]