Looking Back to Plan Ahead

April 20, 2018

Written By Tim Danze

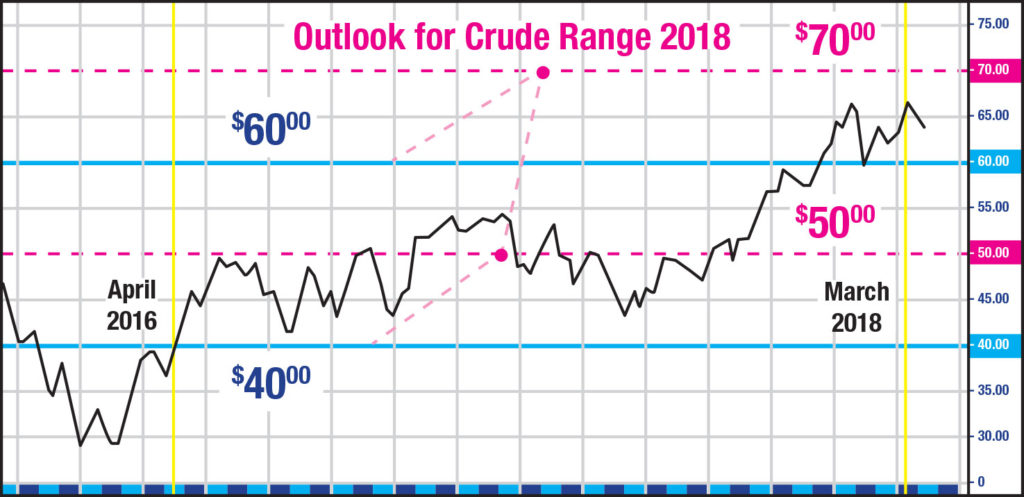

Spring is a good time to look forward to your fuel needs for the fall harvest. So far this year, there’s been plenty of news about the energy industry, but overall, the market’s reaction to said news has been uneventful. Almost two years ago, Tom Kloza, global head of energy analysis for the Oil Price Information Service, spoke at our annual meeting and predicted crude oil would trade between $40 and $60 for roughly the next year. So far, his outlook has proven to be pretty accurate.

Most analysts recently adjusted their forecasts from the $40 to $60 range to a $50 to $70 range for the next year. There are always differing opinions, but the majority of banks and analysts have projected an average WTI (West Texas Intermediate) crude oil price of roughly $63 per barrel, and I agree with that estimate.

With the value of hindsight, we can look back on the year-to-date and make a few observations. Historically, the market has hit a low in the winter time frame, and this year, the market did indeed bottom out in early December before rallying for a month and a half. This was true of both crude oil and ultra-low sulfur diesel (ULSD). In early February, we then saw a correction in crude prices. The correction didn’t bring prices down to the same levels we saw in December, but it was a nice pullback. ULSD put in a new low mid-February. Since that time, crude oil has traded sideways and, for the most part, has been congesting. Meanwhile, ULSD saw a quick rally and pullback before it began trading sideways for about 10 weeks. As I write this article in mid-March, it appears ULSD is poised for its seasonal move higher due to spring demand. WTI crude oil futures are currently sitting at $62 and ULSD futures are trading at $1.91.

The seasonal patterns that have played out have matched trends from past years. However, it’s not always easy to see how these things will unfold when we are living in the moment. That’s why it’s valuable to keep this information in mind as we plan for the rest of the year.

The market could see a correction sometime this spring. If we do see a dip, that would be a great time to check the energy markets and look at where prices stand and review potential fall contract prices. I recommend taking a look at what your needs will be for that period of time and planning accordingly. I’m not suggesting you lock in all of your gallons at once, but you should be working toward contracting at pricing levels that make sense for your operation. Take your overall fuel needs into consideration and use that information to your advantage. Contracting can help you level out your overall price risk and the potential for higher prices heading into the fall while still allowing flexibility in an ever-changing market no one can predict. All of this is predicated on the assumption we won’t see a major event, like a geopolitical uprising in the Middle East, that cuts off crude supplies and disrupts the market.