Fuel Contracting Season is Here

January 20, 2018

Written By Tim Danze

Diesel prices have gone up roughly 55 cents per gallon from the mid-year low, and this is the kind of price rally that we are all trying to protect against by contracting our fuel. This is why putting in a little effort now to determine your fuel budget and target price can be extremely helpful. Obviously, everyone would love to buy the low of the market, but unless you can see the future, it’s hard to get the timing right. However, you can still save yourself some money through fuel contracting by budgeting your fuel needs and knowing the pricing levels that will make sense for your operation.

This is the time of year when most people begin to evaluate fuel contract options and pricing opportunities. Historically, the string of months between November and February have been the time of year to lock in favorable prices for the next season. Anyone who would have done this consistently over the last 10 years would have been doing very well for themselves.

MFA Oil’s fuel contracting program is very flexible and allows you to secure prices that make sense for your budget through fixed-price or maximum-price contracts. Depending upon your plan and your market outlook, you can adjust your protection by the percentage of your total gallons you decide to lock in through contracting. By adjusting that percentage, you can be either more conservative or more aggressive.

The natural question to ask before jumping into a contract is, “Where are prices headed?” But I prefer to ask another question, “Do you think diesel prices can fall 20 cents per gallon from where they currently stand?” If your answer is yes, you should probably wait for the price to fall in line with your expectations before you move forward. But what if you are wrong and prices move higher? Then what do you do?

Fortunately, MFA Oil can help in these types of situations. We offer maximum-price contracts which allow you to lock in a fixed price on a specified number of gallons, and for a 20-cent-per-gallon fee, you get to capitalize on lower prices if the market drops before you take your contract deliveries. But what if the 20-cent premium sounds like too much to pay? Well, then you may be more interested in a fixed-price contract, which still lets you lock in your price, but you do lose the opportunity to take advantage of dips in the fuel market on your contracted deliveries.

Where Prices Stand

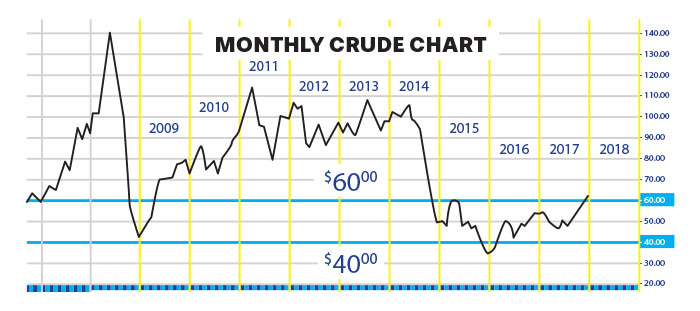

Last year, the mantra was that crude oil prices would trade between $40 and $60 per barrel, and that is what they did. Currently prices are closer to $60 than $40, which is not what we would like to see this time of year when we traditionally look at contracts for next season. There is always a wide variety of opinions about the market, but generally most forecasts have moved the price range up a few dollars higher with expectations of crude trading between $47 to $67.

Seasonally, the market typically trends lower in the winter months, and that is why the November through February time frame has traditionally been a good time to get protection. I am optimistic these seasonal factors could come into play again this year and offer the market downside relief in the next month or so.

A few of the factors which could help create a market pullback include: oil prices nearing two-and-a-half-year highs and the overall run-up of the stock market. The speculative funds in the energy sector are very long on this market in record numbers. These factors tell me this market needs some relief and a corrective pullback would be healthy. Any corrective pullback would offer a chance to buy contracts to protect some of your gallons for next season.

What are some of the bullish concerns that may drive prices higher? The biggest difference from last year is OPEC’s production cut agreement has worked, and inventories around the world are lower. The inventory situation that impacts most of us is the distillate supply here in the Unite States. At this time, in early January, total distillate stocks are 27 million barrels behind last year. That’s not exactly a comfortable level as we head toward the next demand season. If the outlook for good demand growth and a growing economy are correct, the market could struggle to grow supplies. Low supplies and strong demand would be supportive to prices.

Globally, supplies have declined because OPEC has done a good job of adhering to their production cut agreement. Their compliance against the quota has averaged nearly 90 percent for the first half of the year, and Saudi Arabia, the defacto OPEC leader, has been in full compliance. OPEC and non-OPEC countries have pledged to stick with their production cut agreement until the end of 2018.

The biggest offsetting factor to all of the above concerns is U.S. shale oil production. If U.S. shale oil producers can ramp up production to a high enough level, they can basically offset OPEC’s cuts, which would be bearish for prices and the global supply overhang will continue.

The current outlook for domestic shale production is strong and, just recently, the U.S. Energy Information Administration (EIA) raised their already strong production outlook of 60,000 barrels per day to 780,000 barrels per day to a total of 10.02 million barrels per day. The EIA and others have strong forecasts for U.S. shale production, but there are skeptics. MIT did a study that called the EIA forecast method into question and said they were grossly overstating production. Additionally, U.S. shale companies themselves have cautioned the market by focusing on returning profits and not just pumping out production at any cost. Needless to say, whatever happens with U.S. shale production is one of the biggest wildcards at this point in the price equation.

If you want to press the easy button on all this, buy the maximum-price contract. If not, you need to invest time in knowing your budget target price and the current contract price offering for your needs. If your budget price is $2.25 and you can lock in $2.20, that is a winner.