Time to Evaluate Contracting Options

December 25, 2015

Written By Tim Danze

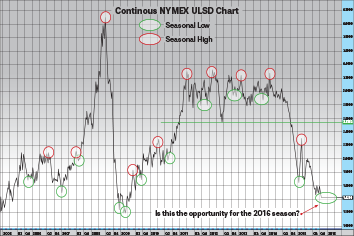

This is a great time to review your fuel contract needs for the upcoming season. Historically, the market drifts lower into the end of the year and offers a good opportunity to lock in fuel prices with fixed-pricing or maximum-pricing contracts.

The energy markets have seen a substantial fall in prices from the highs back in June 2008 and a nice decline from the four-year trading range the market was stuck in from 2011 to 2014. Prices are currently at levels not seen since the Great Recession, and the prices being offered for forward contracts are at similarly low values.

So why is there still a bit of apprehension about locking in prices for this upcoming season? Despite the recent selloff, there are still factors that could pressure the market even lower. The shale oil revolution has provided abundant supplies of crude oil, which has pushed the market to these low levels. Some analysts from the big banks have predicted crude oil prices could hit per barrel prices of $40, $30 and even $20.

The shale oil boom has created a fundamental shift in the U.S. oil industry, and we are still adjusting to the changes. Currently, crude stocks in the United States sit at 482.8 million barrels, which is 102.6 million barrels or 27 percent more than the three-year average. That is a lot of crude oil, thanks in large part to the influx created from shale drilling.

Oversupply is common at the moment. Total U.S. gasoline stocks are currently 5.2 percent above the three-year average and total distillates supplies are 18.8 percent above the three-year average. The question is, when will we see a correction to balance supply and demand?

The number of rigs drilling for crude oil in the United States has fallen off a cliff in the last year, which should impact crude oil production at some point. Last year at this time there were 1,568 drilling rigs and as of right now there are only 572, or nearly a third of last year’s count. Sooner or later, the lower rig count should result in a decrease in crude oil production. Domestic production currently remains above 9 million barrels per day and the market is waiting for a fall below that level as the first sign that production is on the decline. Most economists and analysts have pegged the second quarter of 2016 as the target for supply and demand to become more in line.

Now is the time to make your preparations for the upcoming season and your contract needs. Over the last 10 years, a conservative contract purchase at some point in November through February would have offered good protection on your fuel cost.

Seasonally, it’s time to start paying attention to the market for contract prices. I recommend you start by estimating your usage for the upcoming season. Make sure you account for any changes in the acreage you farm. Another consideration is how your fuel cost or a price level sits within your budget. Know your break-even levels and then look to see how your budget compares to the offered contract prices. If you can lock up a price at or below your budget, that should make it an easy decision.

I suggest trying to lock in a conservative percentage of the gallons you’ll need for the year, say 30 percent, over the next few months. If the market drops during that timeframe, you can look at locking in another round of contracts and lower your average price. Not every year performs the same and there is no guarantee prices will rise this year, but a consistent approach over time has provided a good overall cost savings.